Article

How Section 179 Lets You Write Off Used CNC Machines Before December 31

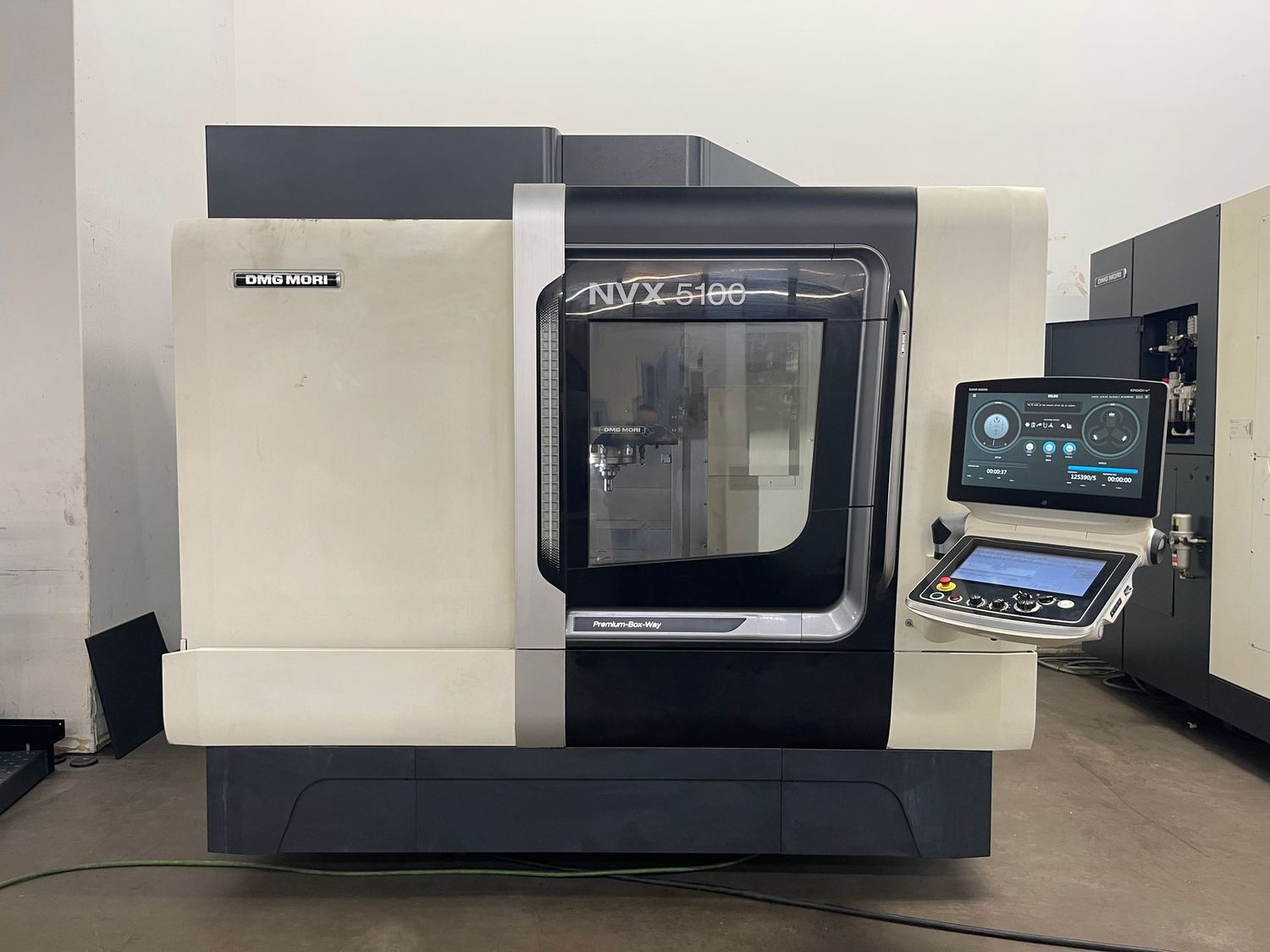

If you’ve been thinking about adding a used Mori Seiki or DMG MORI machine to your shop, there’s never been a better time to pull the trigger.

Thanks to the

Section 179 tax deduction, you can

write off up to $1.22 million of qualifying equipment purchases in 2025 — including used CNC machines — as long as the equipment is in service before

December 31.

At Protech Machine Tool Sales, we specialize in helping shops like yours take advantage of Section 179 with high-quality, ready-to-run Mori Seiki and DMG MORI machines.

That means more capacity, more precision, and a serious year-end tax break.

What Is Section 179?

Section 179 of the IRS tax code allows businesses to deduct the full purchase price of qualifying equipment in the year it’s placed into service — rather than depreciating it over several years.

In short:

Buy a machine this year, start cutting parts before December 31, and you can

deduct the entire cost from your taxable income this year.

For 2025, the Section 179 deduction limit is $1,220,000, with a spending cap of $3,050,000.

After that threshold, the deduction begins to phase out.

The deduction applies to:

- New and used CNC machines

- Machines purchased outright or financed

- Equipment placed into service by December 31, 2025

Why Used CNC Machines Are the Smartest Section 179 Move

A common misconception is that only new machines qualify — not true.

Used equipment qualifies in full under Section 179, as long as it’s new to your business.

That makes used Mori Seiki and DMG MORI machines from Protech the smartest way to maximize your deduction.

Here’s why:

- Immediate availability: No 6-month lead times. Our machines are ready to ship now.

- Lower cost, same deduction: Whether you spend $50 K or $500 K, you still write off 100% of it.

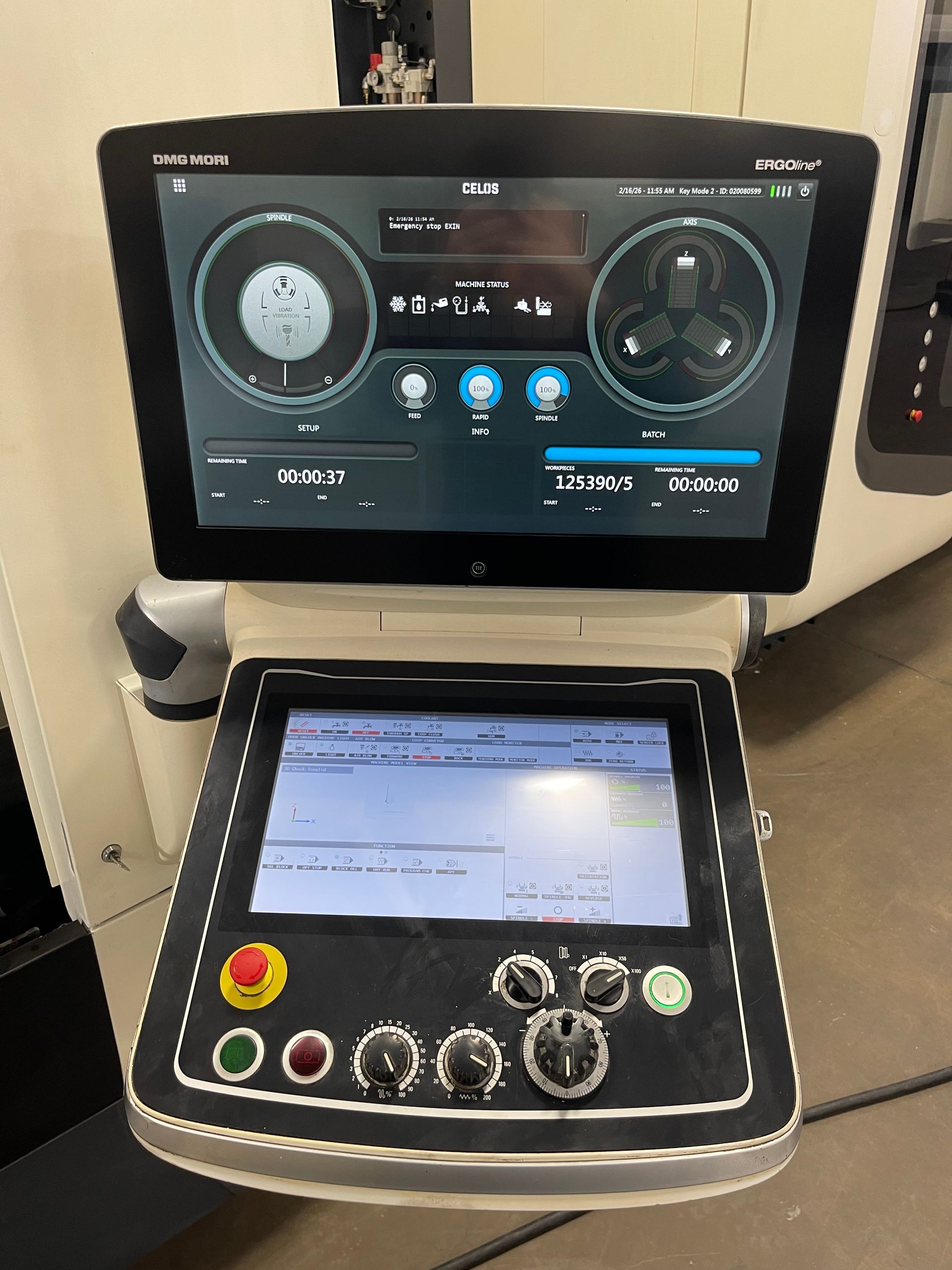

- Fast setup: All machines are powered-on, inspected, and ready to cut — so you can place them into service before the deadline.

Instead of waiting on backorders or paying full retail, you can put proven Japanese-built precision on your floor this month and write it off entirely.

Qualification Checklist

To claim your deduction this year, make sure:

- The machine is purchased, delivered, and operational by December 31.

- It’s new to your company, even if it’s used.

- It’s used for business purposes at least 50% of the time.

- You keep invoice and installation records (Protech provides full documentation).

Our team works closely with buyers every December to ensure their equipment is on the floor, powered up, and fully qualified before the deadline.

Why Shop Year-End with Protech Machine Tool Sales

We make year-end equipment purchases simple and strategic:

- Inventory that qualifies: Every used Mori Seiki and DMG MORI machine in our warehouse meets Section 179 requirements.

- Turnkey logistics: We handle rigging, shipping, and installation so you meet the in-service cutoff.

- Financing options: Lock in a machine today, start payments next year, and still claim the full deduction.

- Documentation ready: We provide everything your accountant needs for your 179 filing.

When you combine Protech’s pre-inspected inventory with the Section 179 deduction, you get the best of both worlds — top-tier equipment and immediate tax savings.

VIEW OUR INVENTORY HERE AND START YOUR DEDUCTION

The Bottom Line

The end of the year isn’t just a deadline — it’s an opportunity.

With

Section 179, every dollar you invest in productivity before December 31 works double-time: once for your shop and again on your tax return.

A reliable Mori Seiki or DMG MORI from Protech Machine Tool Sales gives you the performance you need, the quality you trust, and the tax benefit you deserve.

Don’t wait until January.

By then, the deduction — and your savings — will be gone.

Contact Protech Machine Tool Sales today to lock in your machine, finalize delivery, and claim your Section 179 deduction before the year ends.

DISCLAIMER: This article is for general informational purposes only and does not constitute legal, financial, or tax advice. Section 179 deductions vary based on your company’s specific circumstances, and tax laws are subject to change. Always consult with a qualified accountant or CPA before making any year-end equipment purchases or claiming deductions.